davis county utah sales tax rate

The state sales tax rate in Utah is 4850. This rate includes any state county city and local sales taxes.

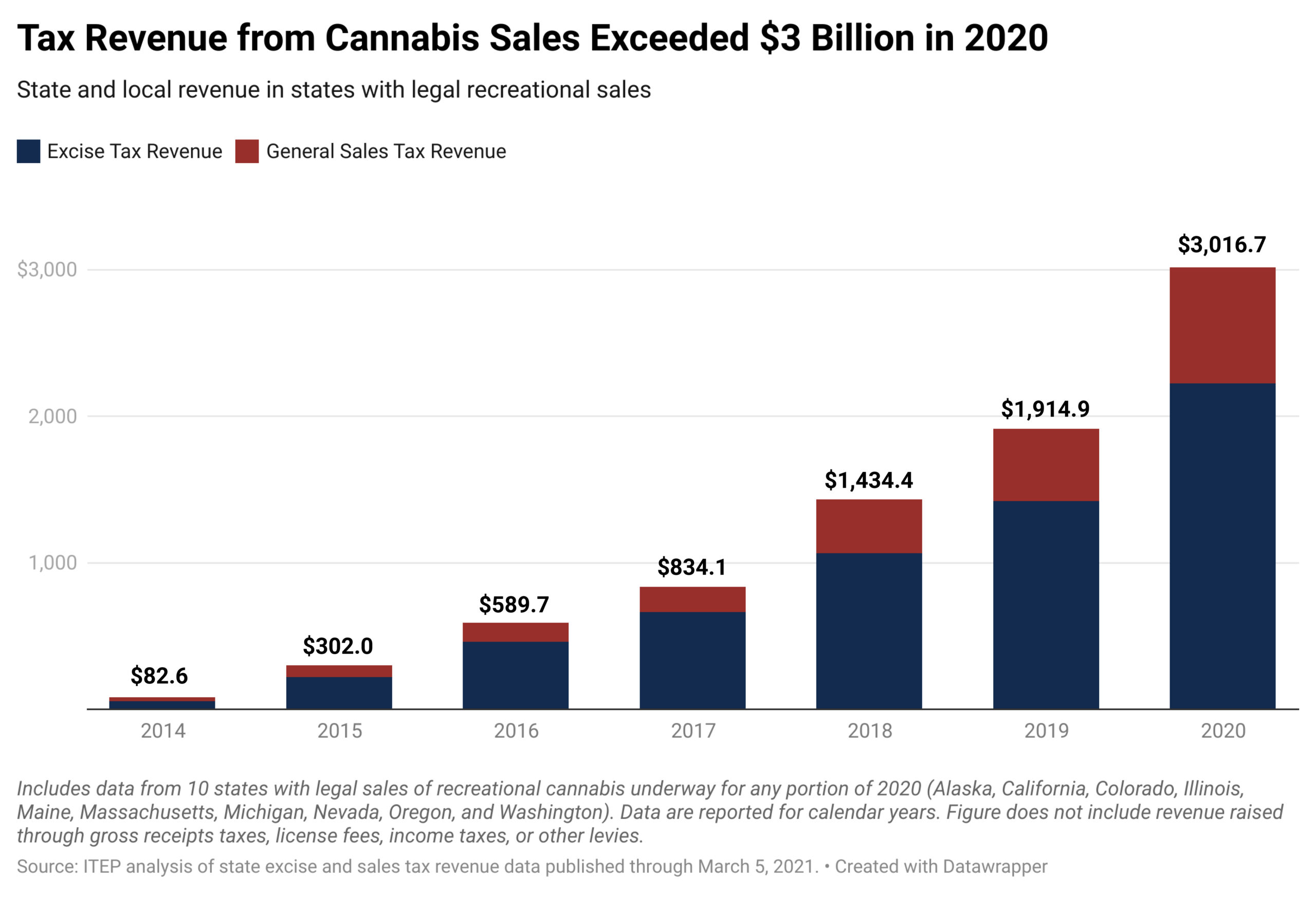

State And Local Cannabis Tax Revenue Jumps 58 Surpassing 3 Billion In 2020 Itep

The Annual Davis County Delinquent Tax Sale was brought to you by.

. This table shows the total sales tax rates for all cities and towns in Davis County. South Weber Davis County will impose an additional 1 transient room tax bringing the total transient room tax rate to 557. October 2018 Local sales and use tax rates will change in several cities and counties in Utah starting October 1 2018.

61 South Main Street Farmington UT 84025. Ad Find Out Sales Tax Rates For Free. Taxpayers may pay real estate property taxes to the Davis County Utah Treasurer using this on-line service or by telephone.

Depending on local jurisdictions the total tax rate can be as high as 87. 7705 or email to taxmasterutahgov. Fast Easy Tax Solutions.

UT Rates Calculator Table. UTAH CODE TITLE 59 CHAPTER 12 - SALES USE TAX ACT. Find your Utah combined state and local tax rate.

The amount you need to pay at the time of vehicle registration varies depending on vehicle type fuel type county and other factors. The 2018 United States Supreme Court decision in South Dakota v. Follow this link to view a listing of tax rates effective each quarter.

See Publication 25 Sales and Use Tax General Information. Local-level tax rates may include a local option up to 1 allowed by law mass transit rural hospital arts and zoo highway county option up to 25 county option transportation town option generally unused at present by most townships and resort taxes. Utah has a 485 sales tax and Davis County collects an additional 18 so the minimum sales tax rate in Davis County is 66499 not including any city or special district taxes.

Local tax rates in Utah range from 0 to 4 making the sales tax range in Utah 47 to 87. Annually a public auction is held for. These payment options are administered by a private company contracting with Davis County.

Businesses shipping goods into Utah can look up their customers tax rate by address or zip code at taputahgov. The 2022 Davis County Delinquent Tax Sale will be held. 94501 Addl.

Utah sales tax rates vary depending on which county and city youre in which can make finding the right sales tax rate a headache. Has impacted many state nexus laws and sales tax collection requirements. 274 rows Washington County.

Davis County UT Sales Tax Rate. 2020 rates included for use while preparing your income tax deduction. The various taxes and fees assessed by the DMV include but are.

Annually a public auction is held for any property which has delinquent taxes. The Utah state sales tax rate is currently. Utah UT Sales Tax Rates by City.

Utah has recent. Farmington Utah 84025 Mailing Address Davis County Treasurer PO. With local taxes the total sales tax rate is between 6100 and 9050.

You may also call the Tax Commission at 801 297-7705 or toll free at 1-800-662-4335 ext. The base state sales tax rate in Utah is 485. The Utah UT state sales tax rate is 47.

The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. The current total local sales tax rate in Davis County. The Davis County sales tax rate is.

Utah has a 485 statewide sales tax rate but also has 131 local tax jurisdictions including cities. The 2022 Davis County Delinquent Tax Sale will be held. What you will find in the US which is different from some other countries is that when you see the price of a product such as a t-shirt in a retail store or food.

Properties may be redeemed up to the time of sale. 31 rows The latest sales tax rates for cities in Utah UT state. Tax rates are also available online at Utah Sales Use Tax Rates or you can contact the Tax Commission at 801-297-2200 or 1-800.

The total sales tax rate in any given location can be broken down into state county city and special district rates. The median property tax in Davis County Utah is 1354 per year for a home worth the median value of 224400. Utah is ranked 964th of the 3143 counties in the United States in order of the median amount of property taxes collected.

Box 618 Farmington Utah 84025 Phone Numbers 801 451-3250. Davis County collects on average 06 of a propertys assessed fair market value as property tax. 20214 Parcel ID 04-046-0036 Owner.

Farmington Utah 84025 Mailing Address Davis County Treasurer PO. Counties and cities can charge an additional local sales tax of up to 24 for a maximum possible combined sales tax of 835. We encourage payment of property taxes on this website see link below or IVR payments at 877 690-3729.

Davis County close to Bountiful UT. 91 rows This page lists the various sales use tax rates effective throughout Utah. You may also call the Tax Commission at 801 297-7705 or toll free at 1-800-662-4335 ext.

To find out the amount of all taxes and fees for your particular vehicle please call the DMV at 801 297-7780 or 1-800-DMV-UTAH 800-368-8824. Once the sale has started open auction the properties will be sold to the highest. You can use our Utah Sales Tax Calculator to look up sales tax rates in Utah by address zip code.

Box 618 Farmington Utah 84025-0618 Phone Numbers 801-451. Koroulis George B Dixie - Trustees Situs. Utah has a higher state sales tax than 538 of.

Davis County 06-000 485 100 025 025 025 025 025 005 715. 2020 rates included for use while preparing your income tax deduction. Tax Rates Subject to Streamline Sales Tax Rules OTHER TAXES APPLY TO CERTAIN TRANSACTIONS Rates In effect as of April 1 2021 Please see instructions below Cnty.

The table combines the base Utah sales tax rate of 625 and the local county rates to give you a total tax rate for each county. Rates include state county and city taxes. The current total local sales.

The Utah state sales tax rate is 595 and the average UT sales tax after local surtaxes is 668. Farmington Utah 84025 Mailing Address Davis County Assessors Office PO. Mobile and manufactured homes may be subject to tax sale when the outstanding taxes are one year delinquent.

Box 618 Farmington Utah 84025-0618 Phone Numbers 801-451-3243. Utah has 340 special sales tax jurisdictions with local sales taxes in addition to the state sales tax. The following sales tax changes were made effective in the respective quarters listed below.

Davis County Administration Building Room 131. First Quarter 2008 Changes. Utah has several different counties 29 in total.

May 18th 2022 1000 am - Pre-registration starts at 900 am.

Utah Tax Rates Rankings Utah State Taxes Tax Foundation

Most States Now Tax Online Purchases Best States Us News

Utah Sales Tax On Cars Everything You Need To Know

High Quality Low Income Housing Low Income Housing Affordable Housing House

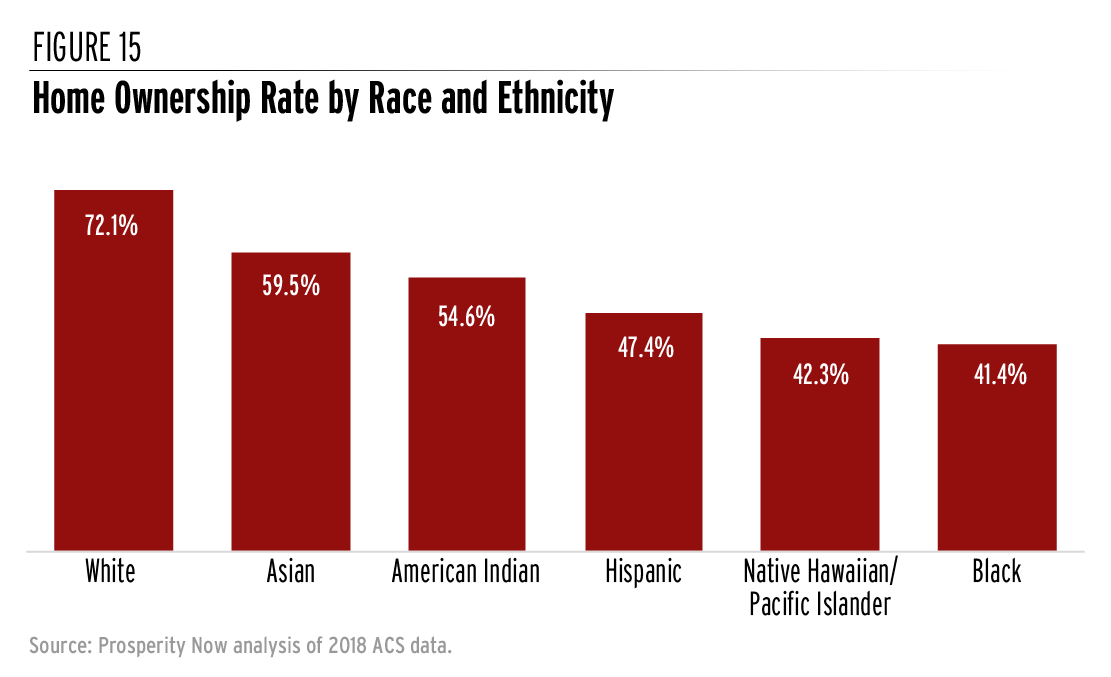

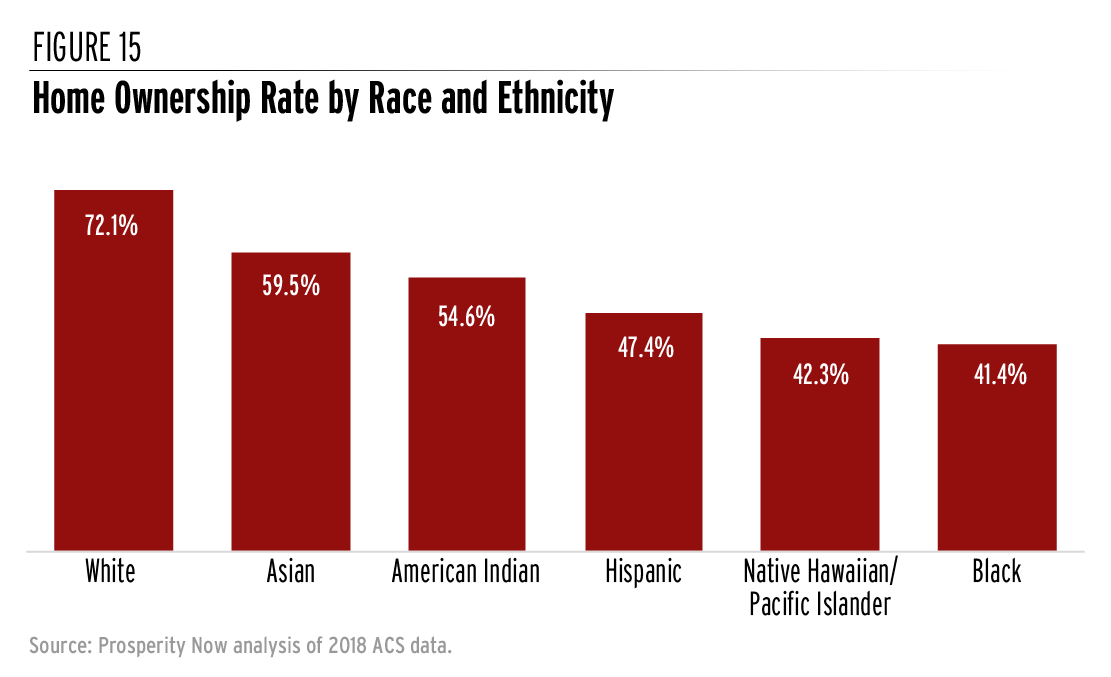

State Income Taxes And Racial Equity Narrowing Racial Income And Wealth Gaps With State Personal Income Taxes Itep

Full Moon Rising By Saija Lehtonen In 2022 Full Moon Rising Moon Rise Full Moon

Top 10 Austin Texas Hotel Deals Texas Travel Texas Travel Weekend Getaways Hotel Deals

13 00 Acres Land Is For Sale In Arkansas Hot Springs Arkansas Arkansas Land Bismarck

Lake Michigan Shoreline Sheboygan Wi Sheboygan Moon On The Water Lake Michigan

Corporate Retention Recruitment Business Utah Gov

Utah Sales Tax Rates By City County 2022

Roadtrippers Magazine Roadtrippers Nevada Travel Las Vegas Vacation Las Vegas Trip